Cuprins

- List of Figures IV

- List of Graphs V

- List of Tables VI

- List of Acronyms and Technical Terminology VII

- Introduction 1

- CHAPTER 1.Tax Havens- an Overview 3

- 1.1. Origins of tax havens 3

- 1.2. Definitions 4

- 1.3. Outlining tax havens 6

- 1.3.1. Characteristics of tax havens 6

- 1.3.2. Financial Secrecy Index 8

- CHAPTER 2.The Impact of Tax Havens 12

- 2.1. Benefits 12

- 2.1.1. Promote investments in heavy taxes countries 12

- 2.1.2. Healthful in taxation 12

- 2.1.3. Stimulates the Economic growth in tax havens 13

- 2.2. Costs 13

- 2.2.1. Harmful impact on taxation 13

- 2.2.2. Unequal distribution of investments 14

- 2.2.3 Consequences of secrecy 16

- 2.2.4. Tax havens a cause of financial crisis 18

- CHAPTER 3.Cayman Islands vs. Roamnia - Case Study 19

- 3.1. Cayman Islands 19

- 3.1.1. Short historical incursion 19

- 3.1.2. General Considerations 20

- 3.1.3. Benefits for the Cayman Islands 23

- 3.2. Romania 28

- 3.2.1. General Consideration 28

- 3.2.2. Short incursion 29

- 3.2.3. Costs for developing countries - Romania 30

- Conclusions 40

- Bibliography 42

- Sytography 43

- APPENDIX 1 45

Extras din licență

INTRODUCTION

History is hard to be understood, scientists discover almost every day something new that may or not change what we have known for that long, and this is valid in each domain. Origins are very hard to be comprehended, especially when we discus about tax havens. Tax haven represents a two-word structure that has a tremendous complexity. This concept has been misunderstood mainly to the fact that they have been under the radar for so long.

The century of speed put an emphasis on the tax evasion and tax avoidance, and many economists struggle to understand the existence of those special jurisdictions, that promotes this type of activity. A fundamental point, which contributed to a better understanding of tax havens were Panama papers, which is a structure that contains 11.5 million documents that were leaked through emails, databases formats, PDFs, images, text documents, and others. The structure that in 2015 quivered the entire world have drawn the attention upon the malefactions of richest, and have made the poorest to be more aware of the veil of secrecy that divides the wealth unequal. Since than this topic is widely discussed on a global scale, and yet there are no substantial measures against tax havens, offshore financial centers, and any other secret jurisdiction.

After four years from the Panama papers people are cognizant of the adverse effects, and that is why they are fighting against them. As almost everyone talks about their negative consequences, I decided to seek out for their benefits, as anything in the world has both a good and a bad side.

This paper was conceived as a result of an assiduous research, that reviewed a wide range of literature, as well as statistical data from Eurostat, World Bank, IMF and others institutions that are preoccupied with the money that are leaked out from our global economy. As the term is a complex one, I was constrained to design my paper after a specific pattern. This pattern includes specifications about the term, its characteristics, as well as a debate upon the benefits and costs.

The structure of the paper is as follows:

1. Chapter I. Abstractions of tax havens

2. Chapter II. The impact of tax havens

3. Chapter III. Cayman Islands vs. Romania- Case Study

The paper encloses two theoretical parts. As I formerly mentioned the origins of tax havens are pretty hard to be understood, and that is the very reason that made me interested to see how the idea of tax havens appeared in the first place.

Chapter one starts with a brief history about tax havens, which further help in defining them. The characteristics were also discussed in this chapter, as well as the Financial secrecy index, which is of great help in measuring the level of secrecy.

Chapter two came as an introductory part for the next chapter, and presents in general the consequences and the benefits of tax havens. The case study points out the positive effects for the Cayman Islands and the negative effects for developing countries, which includes Romania. To back up my findings I collected a wide range of statistical data, majority of them being within the range 2010 -2018. As this subject is very convoluted, and as it was a need for a pattern, in some cases the data there were collected are older than 2010.

The last part points out the most important topics that were discussed, and presents my personal opinion about the future of tax havens.

Bibliografie

A. Books

1. Adams, Charles, For Good and Evil: The impact of taxes on the course of civilization, Second Edition, Madison Book, New York, 2001

2. Anthony, Sanfield, Ginsberg, Tax Havens, Prentice Hall Press, New York, 1991

3. Gabriel, Zucman; Teresa, Lavender, Fagan; Thomas, Piketty, The Hidden Wealth of Nations - The Scourge of Tax Havens, University of Chicago Press, Chicago, 2015

4. Nicholas, Shaxon, Treasure Islands - Tax Havens and the Men Who Stole the World, Ninth Edition, Palgrave Macmillan, London, 2011

5. OECD, Harmful Tax Competition: An Emerging Global Issue, OECD Publishing, Paris, 1998

6. Richard, Murphy, Dirty Secrets - How Tax Havens Destroy the Economy, Verso, London, 2017

7. Ronen, Palan; Richard, Murphy; Christian, Chavagneux, Tax Havens - How Globalization Really Works, Cornell University Press, London, 2010

B. Paperwork and specialized articles

1. European Parliament, European initiatives on eliminating tax havens and offshore financial transactions and the impact of these constructions on the Union’s own resources and budget, http://www.europarl.europa.eu/meetdocs/2009_2014/documents/cont/dv/staes_study/staes_studyen.pdf, accessed June 1, 2019

2. Naomi, Fowler, Accounting for influence: how the Big Four are embedded in EU tax avoidance policy, https://www.taxjustice.net/2018/07/10/accounting-for-influence-how-the-big-four-are-embedded-in-eu-tax-avoidance-policy/ , accessed June 1, 2019

C. Documents, regulations, agreements, official reports and legislations

1. General data about the Romanian agriculture, accessed at https://www.madr.ro/docs/agricultura/agricultura-romaniei-2015.pdf, on June 1, 2019

D. Periodicals, magazines and statistics

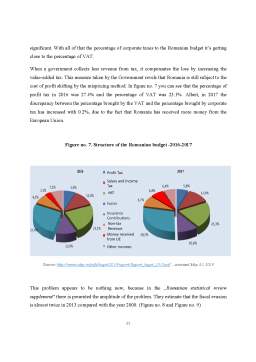

1. National Institute of Statistics, Romanian Statistical Review Supplement, http://www.insse.ro/old/sites/default/files/field/publicatii/revista_romana_de_statistica_supliment_nr1_2017_1.pdf, accessed on June 1, 2019

Preview document

Conținut arhivă zip

- The aftermath of non-taxation Costs vs Benefits.docx